Paywalled, but I’m not shocked that the Torygraph is simping for Milei.

The drastic change in outlook for the country’s rental market adds further weight to arguments that even with the aim of reducing the burden on renters, rent caps often have the opposite effect.

Ah, not just populist, pro-landlord. Not shocking from the Barclays (or Barclay, I guess).

Rent caps are ultimately bad for renters.

This part confuses me. Wouldn’t this be a good thing?

“Worsening the situation, 45pc of landlords decided to sell their properties in the wake of the announcement significantly reducing the amount of accommodation on offer and further pushing up prices.”

Yes, the number of rental properties declines, but that would mean home ownership would increase, right? I know my bias is toward the North American model of a multiyear fixed rate mortgage. I also know that the model exists in Europe about essentially interest only mortgage where you never actually pay down your mortgage, but your interest payments are essentially your housing costs.

How does it work in Argentina? How do people buy houses? Are they instead all cash transactions or do mortgage schemes exist there in some form?

My English is not the best but I believe, given the weird way this was redacted, that are talking about what happened with the previous leftist government:

`The rules, introduced in 2020 by then-president Alberto Fernández, included a mandatory lease term of three years and a limit on rent to an average growth rate of the consumer price index and the wage index. This cap was set by the central bank.

Even before the new legislation came into force, the effect was significant. Unsure of how much and when they would be able to increase rents, landlords hiked their pieces to try and avoid being caught out.

Worsening the situation, 45pc of landlords decided to sell their properties in the wake of the announcement significantly reducing the amount of accommodation on offer and further pushing up prices.`

Because this did happen with the previous government when they instated the rent controls.

Now after Milei’s deregulation, we have more rent offer than ever, which allowed for a market dinamic. People now can choose where to rent with in turns let’s the prices lower as rentals have to compete with each other’s

My English is not the best but I believe

First, your English is very good!

I am understand why landlords sold (when the price caps on rents were put in place).

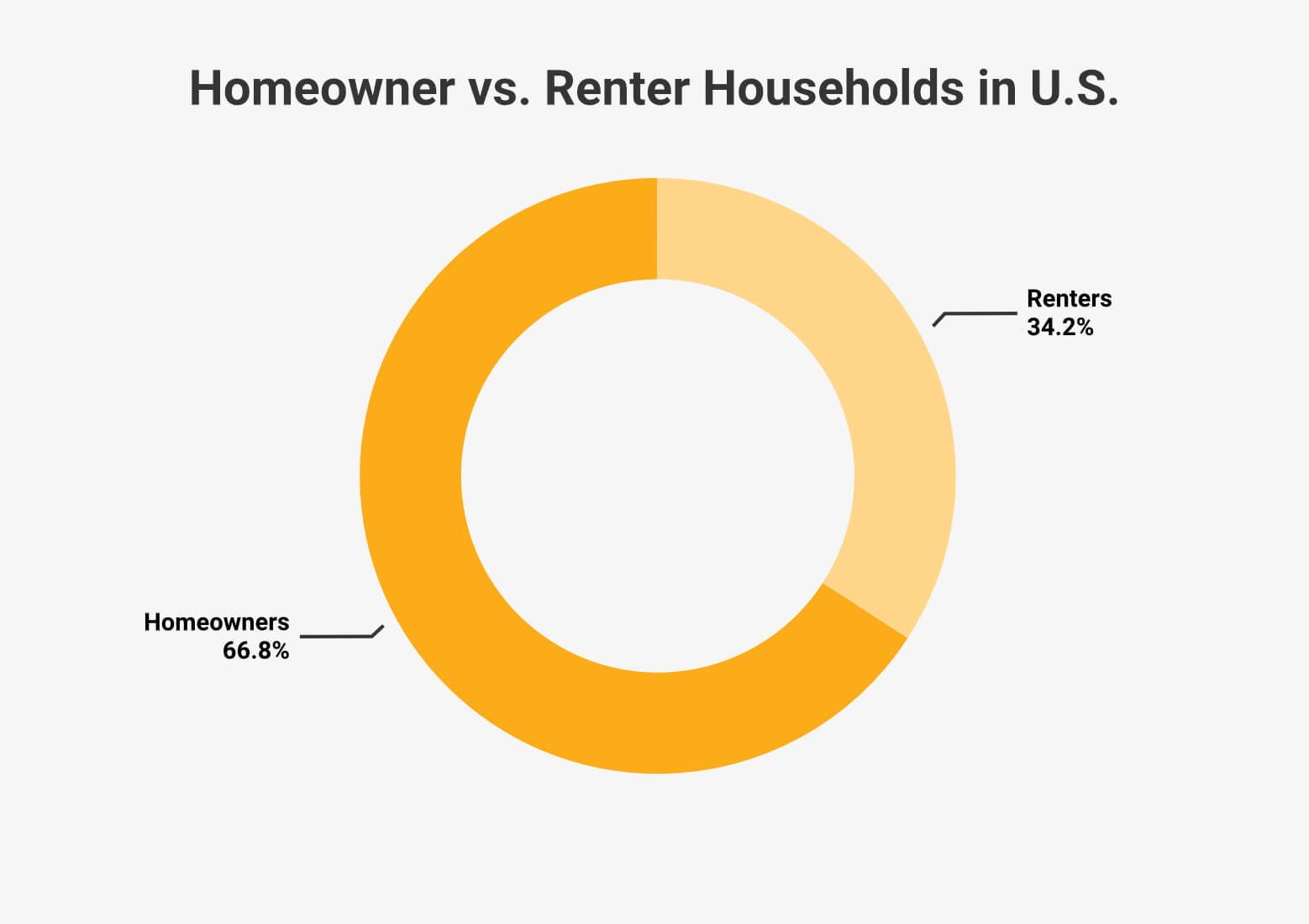

I’m wondering if I am not understanding how people in Argentina pay for housing. In the USA most people buy the homes they are living in for housing:

Purchases of homes are either done in cash (more rare) where the buyer owns the home entirely at the time of purchase, or they get a loan from a bank (a mortgage) usually spanning 15 or 30 years. If they are borrowing from a bank, then they must pay a portion of the loan and interest back monthly. This is the mortgage payment. At the end of the 15 or 30 years, the buyer owns the home entirely themselves and does not have to make a monthly payment on their home. I’m simplifying this a bit and ignoring that homeowners need to pay monthly insurance and taxes on their homes usually.

Those that either cannot afford to buy their home (or choose not to for other reasons) pay a monthly rent to the owner of the property (landlord).

Is this the same way people pay for their housing in Argentina, or does it work differently?

Most people here cannot save enough for a down payment for a house /department. So the only solution are mortgages. Little problem is that mortgages have been absent in anything but paper so Argentines have not been able to acquire property or housing with ease since years ago

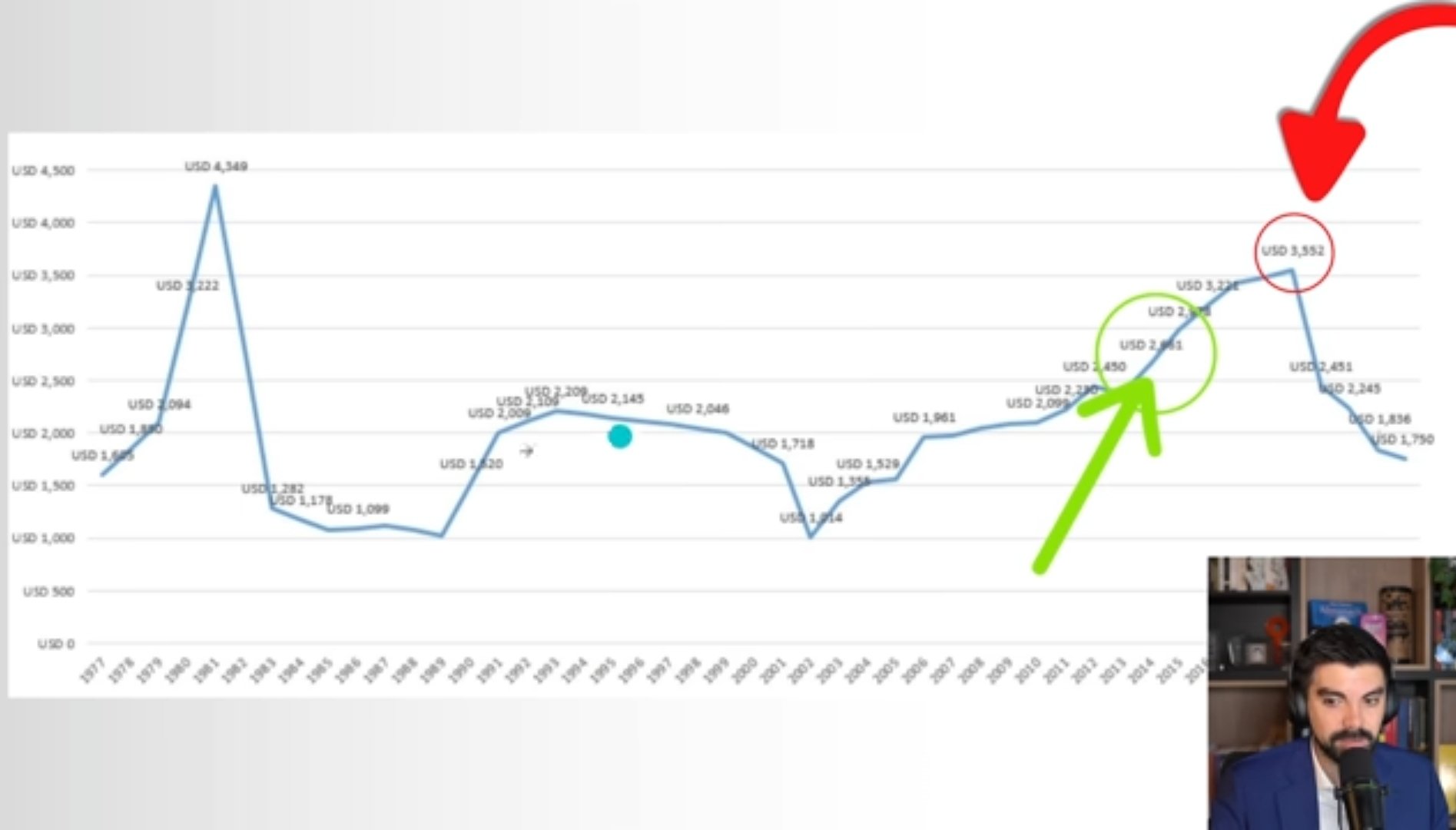

Last time mortgages were available, it was in 2017/2018. After the currency devaluation that came on 2018/2019, banks, understandably, faced towards different ways of earning interest on their capital savings. Banks turned to high interest, high yield governmental bonds during the last 4 years, which was the way the leftist government found to capture all the extra pesos they were printing thrift the central bank daily to subsidize everything from food to services.

Little problem? The interest rates implied that the central bank had to pay even more pesos to the banks every time. So to avoid paying in an unpredictable bank run, they kept increasing the interest rate, therefore the banks would keep their money on the aforementioned bonds, the interest would increase, then to avoid an unpredictable bank run, the government would increase interest rates again and so on.

It was a literal trap.

But that explains why banks would not loan money for mortgages. Why would they if they had the government at their service printing money for them?

It’s not for nothing that the arrival of Milei is so celebrated by the 57% voting population. They guy literally saved us from hyperinflation.

Now thanks to Milei, banks now have to work and earn their money through real lending, not just interest rates being hiked at the expense of the people

Little problem is that mortgages have been absent in anything but paper so Argentines have not been able to acquire property or housing with ease since years ago

Last time mortgages were available, it was in 2017/2018.

This is the major piece of information I was missing! Thank you!

So even with the price of housing for sale falling substantially (because of the rental price caps), unless a would-be home buyer had 100% of the cash to buy the home (which I imagine is very rare), then they simply couldn’t get a loan (mortgage) at all. So they couldn’t buy the, at the time, very cheap housing even if they wanted to.

That explains it very clearly. I appreciate the time you took to explain that. I also appreciate the rest of your explanation about the further actions of currency devaluation impacts, banks on investment in government bonds, and the impacts on the nation from having to pay interest on those bonds at the inflated yields. Thanks!

Not not good. Means there is no money to be made in renting and less houses will be built because of it.

Ultimately it is a supply and demand issue. Long term effects are more important in the housing market than short ones. These are short term effects.

Not not good. Means there is no money to be made in renting

Right, because of the government imposed price cap. The article covers that.

and less houses will be built because of

Where does this part of the idea come from? There’s no price controls on buying or selling housing, therefor should be no negative impact on the market. Further, the price of homeowners buying housing should have been temporarily cheaper because landlords were unloading properties instead. Private home ownership is a really good solid foundation for an economy.

Unfortunately a healthy housing market is surprisingly a good thing. It’s like when house prices collapse it’s actually a bad thing because the reason that happened is worse than the result on the house prices (e.g. 2008). People look at the system far to simply, do not understand it and make the wrong judgements. It’s the problem of a little bit of knowledge being a dangerous thing.

Because there is no value it building a house because there is no value in buying one.

Many many people have talked about the issues of price caps. It’s been done to death. Go look up a podcast, YouTube video, book, seminar, webpage of your choosing and find out why rent caps are bad. They will do a better job of explaining it than me and you can consume the information in the way you want.

Personally I would like some big changes to be made. Easiest of which would be a land value tax which would increase homes and decrease prices. Or much more radical things like destroying parts of cities. Unfortunately I don’t make those choices. So reading the information here is showing the opposite of what you think it does and in the system being used is good news.

Unfortunately a healthy housing market is surprisingly a good thing.

“Unfortunately” “a good thing”. These two things don’t seem to work together. Typo? ESL?

It’s like when house prices collapse it’s actually a bad thing because the reason that happened is worse than the result on the house prices (e.g. 2008).

If you’re speaking about the USA in 2008 that’s a bad example compared to Argentina here, yes? In the USA the collapse was lenders extending mortgages to buyers that had no chance of paying them back, yet selling those mortgages as though they were good investments.

Are you suggesting Argentina was experiencing a liquidity issue like the USA was, and if so, the imposition of price caps on just rentals, not ownership should have no effect on it unless you’re saying the price caps on rentals perfectly overlaps with a liquidity crisis.

People look at the system far to simply, do not understand it and make the wrong judgements. It’s the problem of a little bit of knowledge being a dangerous thing.

You can use that throwaway line, but if you are making an argument, you have to defend it.

“That which can be asserted without evidence can be dismissed without evidence.” (Christopher Hitchens).

Because there is not value it building a house because there is no value in buying one.

Again, we’re talking about just rental caps, not home ownership. And again, the reason that landlords were selling was because of price caps on rents. People wanting to buy homes for housing (and not rent) should be in a fantastic position to purchase.

Many many people have talked about the issues if price caps. It’s been done to death. Go look up a podcast, YouTube video, book, seminar, webpage of your choosing and find out why rent caps are bad. They will do a better job of explaining it than me and you can consume the information in the way you want.

Are you even reading my posts? I am not advocating for rental price caps, I’m asking why when the price caps were imposed that home ownership did not go up from the landlords putting more homes on the market.

Personally I would like some big changes to be made. Easiest of which would be a land value tax which would increase homes and decrease prices. Or much more radical things like destroying parts of cities. Unfortunately I don’t make those choices. So reading the information here is showing the opposite of what you think it does.

The following is true as reported in the article: Rental units are disappearing from the market (which is what happened here with the imposition of price caps on rentals and landlords sold).

Where did all the renters go that no longer could rent because the landlords removed so many units from rental markets? They have to live somewhere. Where?

Was the rental market over saturated and even with so many landlords removing rental units there was still enough rental supply for 100% of renters?

…OR did they buy houses instead of renting?

No that was sarcasm are you ESL?

Unfortunately for Lemmys a professor of economics knows more about the economy than they do. He is making the housing market healthier and they don’t like that.

If you’re speaking about the USA in 2008 that’s a bad example compared to Argentina here, yes?

I was trying to show an obvious example of how decreasing house prices can be a bad thing. It’s an similar example, it is not the same. I was hoping to show you how just because something on the surface appears to be good it can be bad.

You can use that throwaway line, but if you are making an argument, you have to defend it.

“That which can be asserted without evidence can be dismissed without evidence.” (Christopher Hitchens).

What a horrific misuse of that quote. I’m talking about economy theory that has been well studied. Evolution doesn’t need to be proved every time it is mentioned why does this? At this point you need to assert against general consensus.

Okay right. With price caps total homes, now and in the future for rentals added to ownership decrease. This can put pressure on prices to rise overall for rentals and for home ownership.

Where did all the renters go that no longer could rent because the landlords removed so many units from rental markets? They have to live somewhere. Where?

Parents, friends, the street, foreign countries some of them would have gotten a home certainly but not all. At this point you will really need to be digging into the data and things get complicated and hard to count exactly.

I see your confusion now. The market is not over saturated, that’s the mistake you are making in your thinking. It’s a supply and demand curve. More people would rent if it became cheaper when it becomes more expensive less people do. Frankly it is as simple as that. Less people get to live where and how they want as cheap as they would like that’s why rent control is so awful. This effect can put a similar effect on home ownership. People that can, then buy when they don’t want to at a price they aren’t happy with in a location they don’t want. Some people just can’t afford to buy a house when they once could. It just fucks over the whole market and pretty much everyone is less happy.

You seem interested in it. Go investigate. No point arguing with some random guy on a forum, go look at some quality content.

Not all rentals will become purchased homes. From a people living in it point of view homes disappear off the market. The problem also gets worse and worst over time, assuming the population of the city is increasing.

I’m tired I’m come back later and re read everything and see if I need to explain anything better then.

I’m tired I’m come back later and re read everything and see if I need to explain anything better then.

No need. Read @[email protected] 's explanation. I got the missing piece which explains it (and its not even close to anything you were talking about).

I got the answer to my original question of “why home ownership didn’t increase when property values fell?”.

Its this:

“Little problem is that mortgages have been absent in anything but paper so Argentines have not been able to acquire property or housing with ease since years ago”

… and this…

“Last time mortgages were available, it was in 2017/2018.”

Would-be home buyers couldn’t get mortgages because banks wouldn’t lend to anyone. Full stop.

You and I were trying to apply normal market conditions that exist in the USA. Instead I took the approach of asking how Argentinians house themselves and Shardikprime seems to have the regional knowledge both you and I were missing.

True in fact property prices are at An All time low now in Argentina

Lol.

Its actually a really interesting article. But it goes against what people want to be true with what is actually true.

People are down voting this because they want to live in fantasy land. Can we not actually upvote things that are informative and in areas where people knowledge is lacking. This article can be a learning point for you all or you can all live in denial.

Thank you for your nuanced take